Venture Capital Articles & Startup Insights for Founders & Investors

Actionable insights, emerging trends, and strategic advice for startup founders, angel investors, and VCs investing in early-stage startups across the USA and Canada.

Most Popular Articles

All Articles

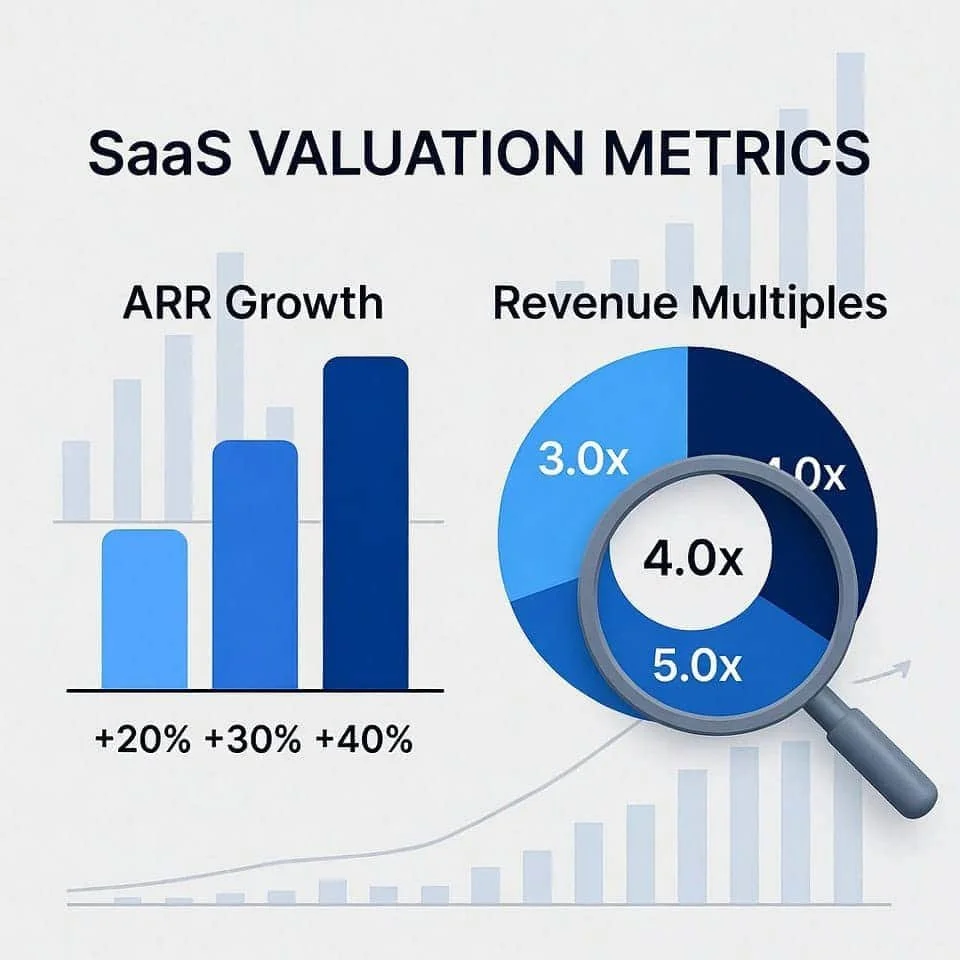

ARR Growth vs. Revenue Multiples: Unveiling Their Distinct Roles in SaaS Valuation

A clear guide to ARR Growth vs. Revenue Multiples in SaaS valuation, explaining metrics, market drivers, and how investors assess growth, efficiency, and value.

Expert Q&A: Navigating Cross-Border Investment Risks for Angel Investors in Early-Stage Tech Startups

Your expert guide to cross-border angel investing in tech startups. Navigate legal risks, currency volatility, and cultural differences for global returns.

Decoding Canada's Federal Budget 2025: Strategic Insights for Entrepreneurs, Startups, and Investors

Decode Canada's Federal Budget 2025: Strategic insights on funding, tax incentives, AI investment, and growth opportunities for entrepreneurs and investors.

Meta AI Layoffs: What 600 Job Cuts Mean for Zuckerberg’s Superintelligence Strategy

Analysis of Meta's 600 AI job cuts and implications for Mark Zuckerberg's superintelligence ambitions. We explore workforce restructuring, AGI strategy shifts, and the future of Meta AI development.

From Startup to $8B Valuation: A Polymarket Case Study on the Lifecycle of Prediction Markets and Timeless Lessons for Founders and Investors

Explore how Polymarket navigated regulatory hurdles and leveraged technology to achieve an $8 billion valuation, offering key insights for founders and investors.

What to Expect from the Databricks IPO in Late 2025: Key Dates, Valuation & Risks

Explore the anticipated Databricks IPO, its valuation, key milestones, $100M OpenAI deal, risks, and investment opportunities in the AI and data analytics landscape.

Liquidation Preferences: Investor vs. Founder Interests

Explore how liquidation preferences shape the financial landscape for investors and founders, impacting exit outcomes and negotiations.

Side Letters vs. Standard LP Agreements

Explore the differences between standard LP agreements and side letters in venture capital, balancing standardization with investor-specific needs.

10 Questions to Ask Founders Before Investing

Explore 10 essential questions to ask founders before investing, focusing on their vision, experience, and strategies for success.

Why Investors Value the Rule of 40 in SaaS Startups

Learn how the Rule of 40 helps investors assess SaaS startups by balancing growth and profitability for sustainable success.

How FX Risk Impacts Startup Valuations

Understanding FX risk is crucial for startups and investors as currency fluctuations can significantly impact revenue, costs, and overall valuations.

Figma IPO: How Underpricing Cost $3 Billion and What This Bullish IPO Teaches Founders

Figma's bullish IPO highlights the pitfalls of underpricing, resulting in billions lost by founders and employees while benefiting institutional investors.